Original link: http://tecdat.cn/?p=24162

In this example, we consider Markov transformation stochastic volatility model.

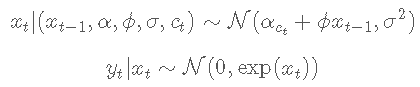

statistical model

Let yt be the dependent variable and xt be the unobserved logarithmic volatility of yt. For t ≤ tmax, the stochastic volatility model is defined as follows

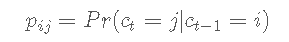

The state variable ct follows a two state Markov process with transition probability

N(m, σ 2) Represents the mean M And variance σ Normal distribution of 2.

BUGS language statistical model

File content ' vol.bug':

dlfie = 'vol.bug' #BUGS model file name

set up

Seed random number generator for repeatability

set.seed(0)

Load models and data

model parameter

dt = lst(t\_mx=t\_mx, sa=sima, alha=alpa, phi=pi, pi=pi, c0=c0, x0=x0)

Parse and compile BUGS model and sample data

modl(mol\_le, ata,sl\_da=T)

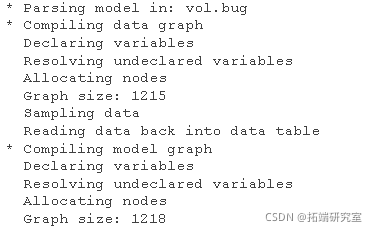

Draw data

plot(1:tmx, y, tpe='l',xx = 'n')

Logarithmic rate of return

Sequential Monte Carlo_ Sequential Monte Carlo_

function

n= 5000 # Number of particles

var= c('x') # Variables to monitor

out = smc(moe, vra, n)

Model diagnosis

diagnosis(out)

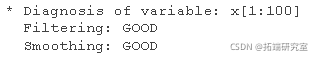

Drawing smoothing ESS

plt(ess, tpe='l') lins(1:ta, ep(0,tmx))

SMC: SESS

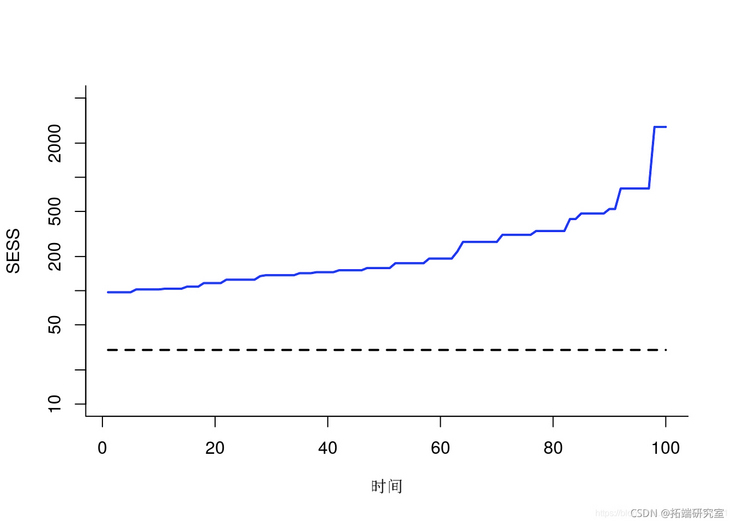

Paint weighted particles

plt(1:tax, out,)

for (t in 1:_ax) {

vl = uiq(valest,\])

wit = sply(vl, UN=(x) {

id = utm$$sles\[t,\] == x

rtrn(sm(wiht\[t,ind\]))

})

pints(va)

}

lies(1t_x, at$xue)

Particles (smooth)

Summary statistics

summary(out)

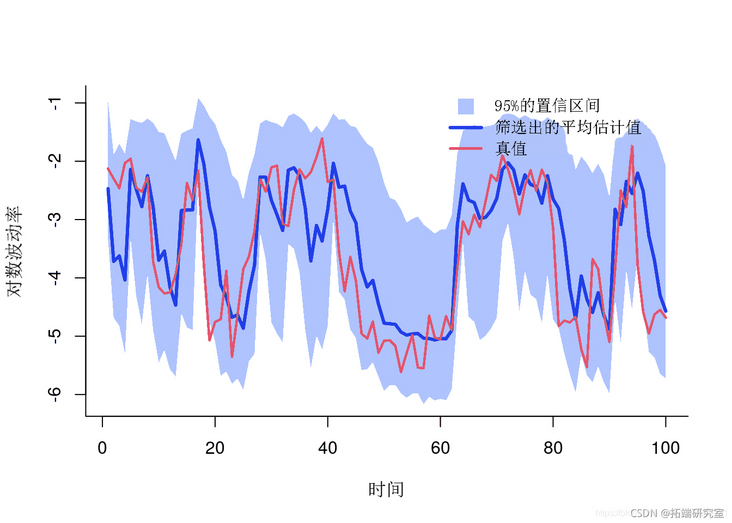

Mapping filter estimation

men = mean qan = quant x = c(1:tmx, _a:1) y = c(fnt, ev(x__qat)) plot(x, y) pln(x, y, col) lines(1:tma,x_ean)

Filter estimation

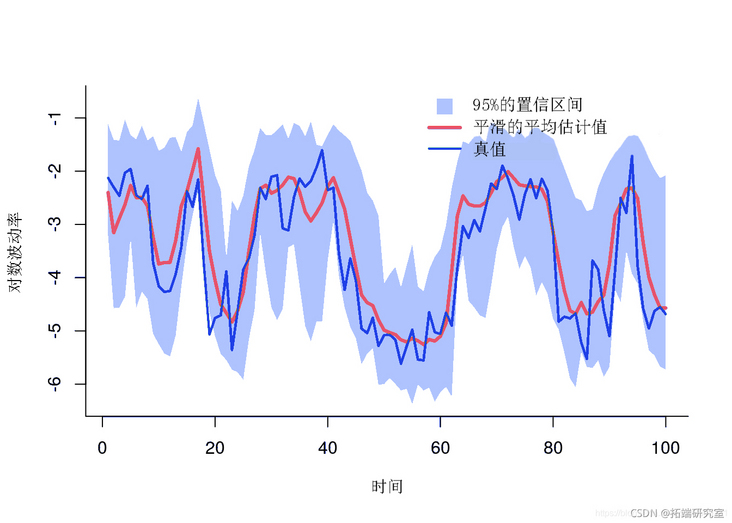

Mapping smoothing estimation

plt(x,y, type='') polgon(x, y) lins(1:tmx, mean)

Smoothing estimation

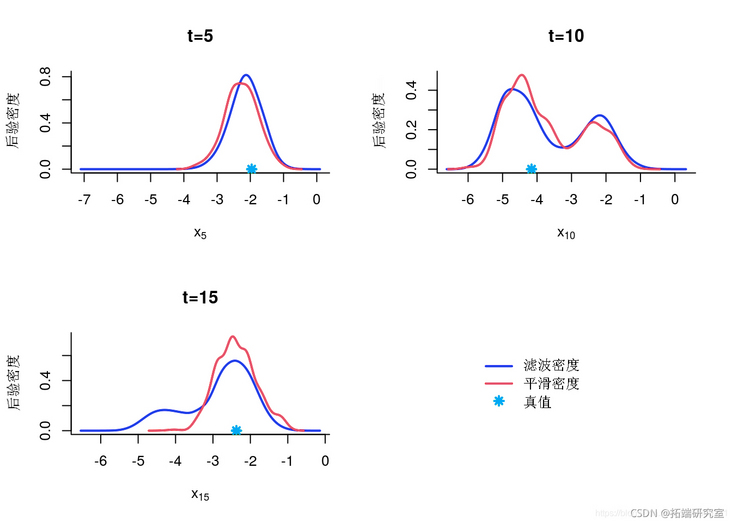

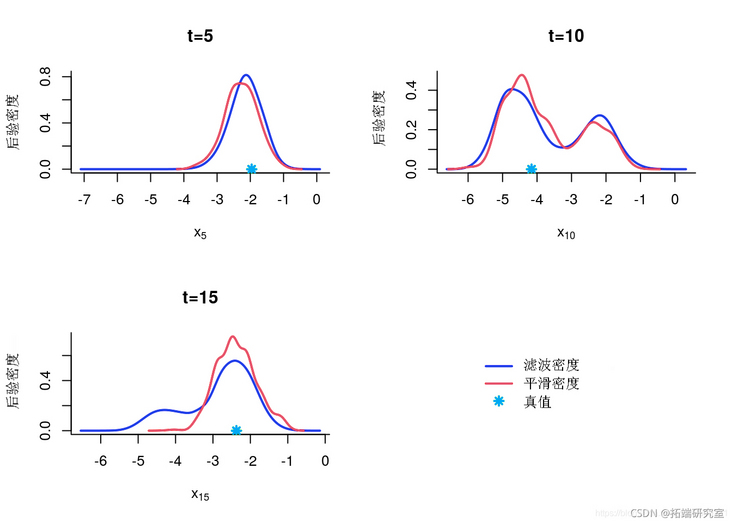

Edge filtering and smoothing density

denty(out)

indx = c(5, 10, 15)

for (k in 1:legh) {

inex

plt(x)

pints(xtrue\[k\])

}

Marginal posterior

Particle independent metropolis Hastings

function

mh = mit(mol, vre)

mh(bm, brn, prt) # Pre burn iteration

mh(bh, ni, n_at, hn=tn) # Return sample

Some summary statistics

smay(otmh, pro=c(.025, .975))

Posterior mean and quantile

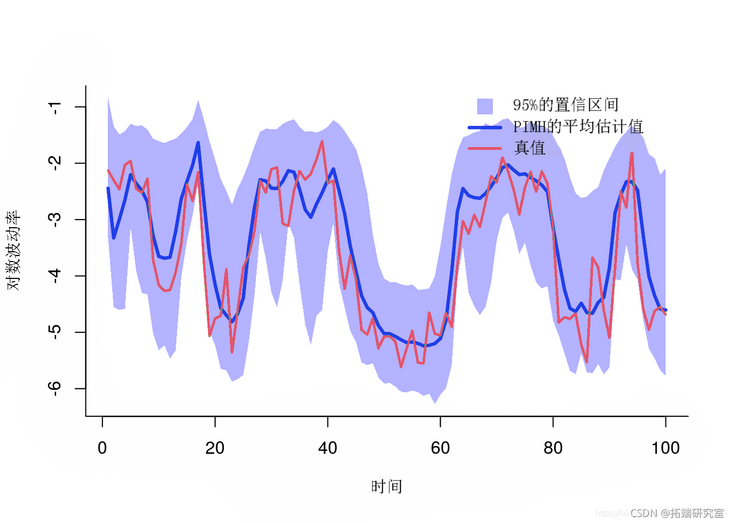

mean quant plot(x, y) polo(x, y, border=NA) lis(1:tax, mean)

Posterior mean and quantile

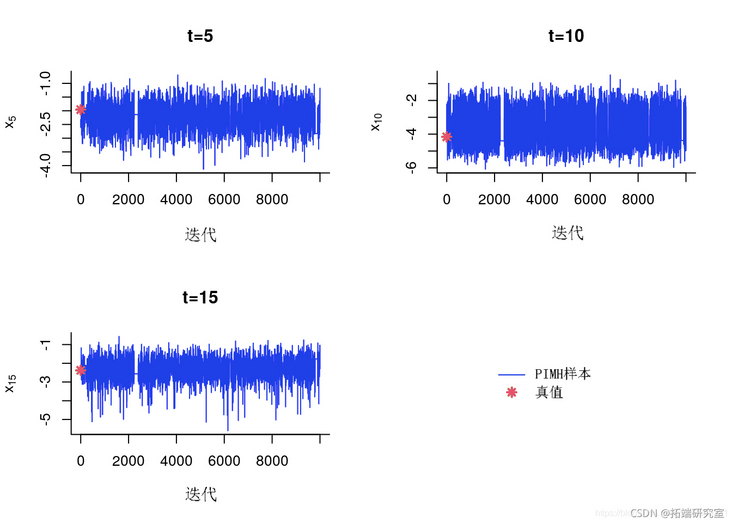

Trace map of MCMC samples

for (k in 1:length {

tk = idx\[k\]

plot(out\[tk,\]

)

points(0, xtetk)

}

Tracking sample

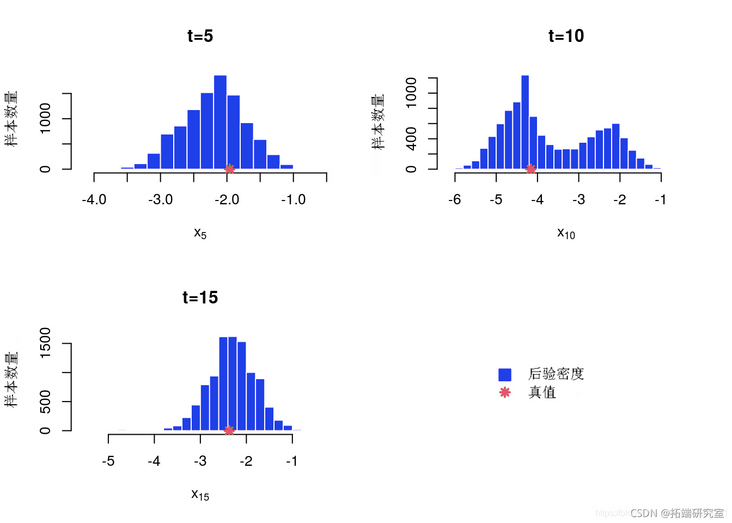

A posteriori histogram

for (k in 1:lngh) {

k = inex\[k\]

hit(mh$x\[t,\])

poits(true\[t\])

}

Back edge histogram

A posteriori kernel density estimation

for (k in 1:lnth(ie)) {

idx\[k\]

desty(out\[t,\])

plt(eim)

poit(xtu\[t\])

}

KDE posterior edge estimation

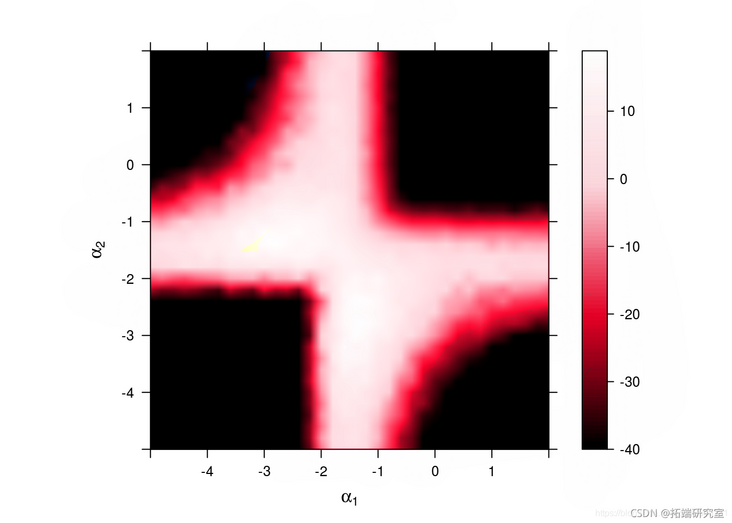

sensitivity analysis

We want to study the parameters α Value sensitivity

Algorithm parameters

nr = 50 # Number of particles

gd <- seq(-5,2,.2) # A numerical grid of components

A = rep(grd, tes=leg) # Value of the first component

B = rep(grd, eah=lnh) # Value of the second component

vaue = ist('lph' = rid(A, B))Operational Sensitivity Analysis

sny(oel,aaval, ar)

Plot LOG edge likelihood and penalty LOG edge likelihood

# Avoid standardization problems through threshold processing thr = -40 z = atx(mx(thr, utike), row=enth(rd))

plot(z, row=grd, col=grd, at=sq(thr))

Sensitivity: log likelihood

Most popular insights

2.WinBUGS on multivariate stochastic volatility model: Bayesian estimation and model comparison

3.Realization of Volatility: ARCH model and HAR-RV model

5.R language stochastic volatility model SV is used to deal with stochastic volatility in time series

6.R language multivariate COPULA GARCH model time series prediction

7.VAR fitting and prediction based on ARMA-GARCH process in R language

9.ARIMA + GARCH trading strategy for S & P500 stock index in R language